texas travel nurse taxes

Housing stipends are tax-free allowances which means you benefit financially without having to pay taxes on extra wages. We offer a personalized approach that maximizes legitimate deductions and avoids ones that.

Ask A Nurse What Tax Benefits Can I Claim As A Registered Nurse Nursejournal

The sticker shock from SE tax is real so be ready to be smacked with that 153.

. For jobs available on Vivian as of Monday August 8th 2022 the average weekly salary for a Travel Registered Nurse in Texas is 2270 but can pay up to 5722 per week. These fees are a non-negotiable expense associated with getting a job through an agency. Your report all your income on your home state return even the income earned out of state.

Two basic principles are at work here. Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. Episode 1 Tax Deductions.

Expand Your Nursing Career. 12 for taxable income between 9876 and 40125. Ad TNAA has Experts in Housing Payroll Clinical Care.

Travel Nurse Tax Questions Videos. Here When You Need Us. Basically only income earned in California is taxed there.

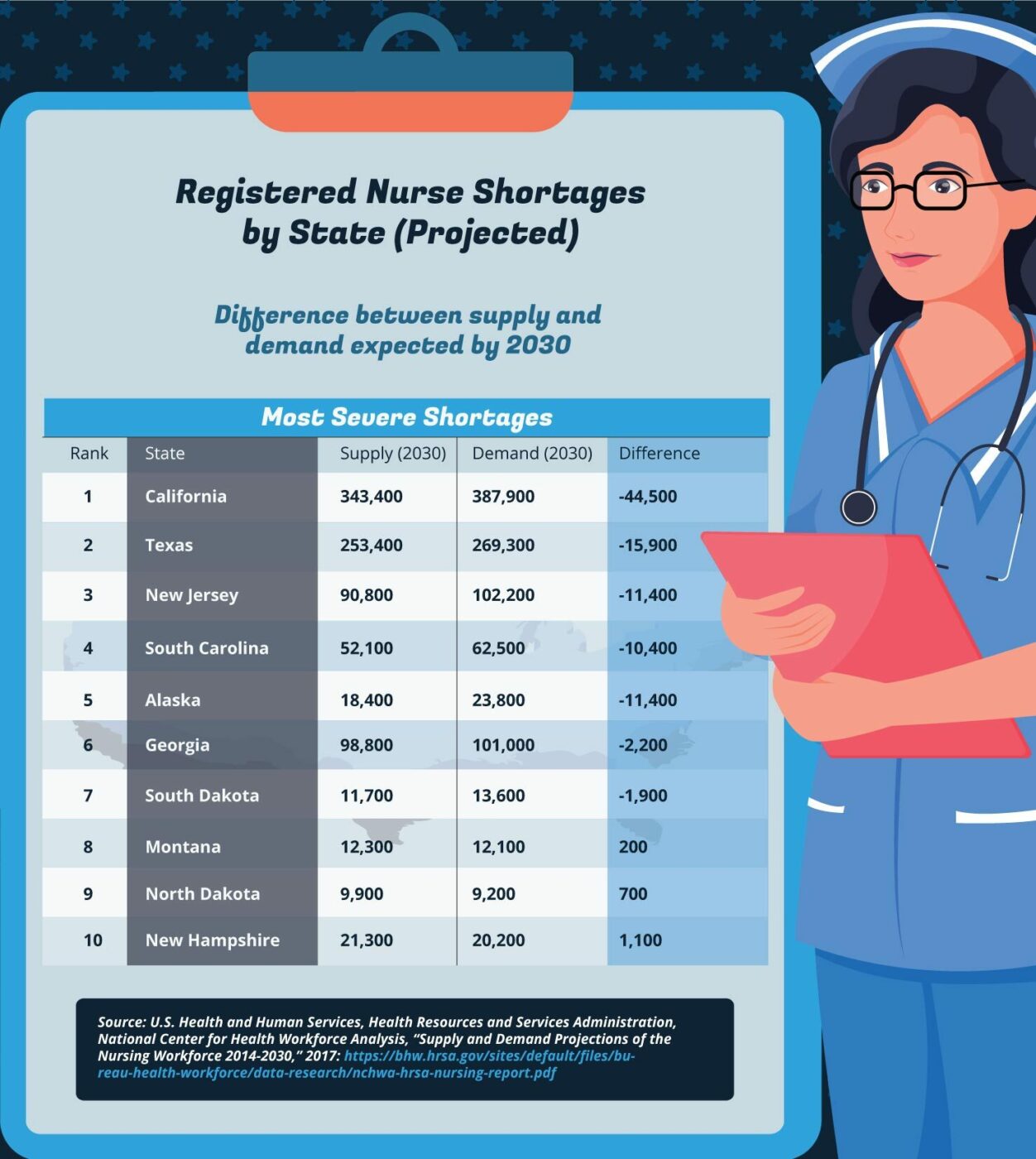

There are many factors to consider when talking about how much travel nurse get paid including. However recently-licensed travel nurses tend to earn a much lower starting salary of 3771 while their more experienced counterparts earn an average of 8206. But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence.

At first glance this sounds like double taxation but this is not the case. Protects the public from unsafe nursing practice provides approval for more than 200 nursing education. What is a deduction and what can you use for a deduction as a Travel Nurse.

When looking to optimize pay its important to understand that pay packages differ based on specialty and location. The BON has been serving the public for more than 100 years since its establishment in 1909 by the Legislature to regulate the safe practice of nursing in Texas. May 9 2019.

First and foremost a higher tax bill. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Not just at tax time.

They help pay for things like. When a healthcare facility hires a travel nurse through a staffing agency like RNnetwork part of the money the facility pays goes to cover vendor and agency fees while the rest goes to pay the nurse. No one enjoys paying taxes and many of us try hard to find ways to reduce our tax payments.

RN salary in Alaska - Median Hourly. You file a non-resident state return for the state you worked in and pay tax to that state. Not sure what you can deduct.

2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before. Thats the tax rate on one more dollar of income he says. At the same time the work state will tax the income earned there.

We welcome you to the Texas Board of Nursing BON or Board website. Some of this may include overtime hours though the availability and demand for overtime will vary from one assignment to. Episode 2 Audit Triggers.

In this post well help you understand how Travel Nurse stipends work so that you can get the most out of traveling while playing by the rules. Travel Nurse Housing Stipends Are Tax-Free. Vendor and agency fees.

RN salary in California - Median Hourly. First your home state will tax all income earned everywhere regardless of source. RN salary in District of Columbia - Median Hourly.

Refer to the GSAs federal Domestic Maximum Per Diem Rates effective Oct. Texas Washington and Wyoming do not have income tax. While higher earning potential in addition to tax advantages are a no.

The fact that the income was not earned in the home state is irrelevant. Below is the median hourly rate for registered nurse salaries in several popular destinations current as of 2020 according to the BLS. 22 for taxable income between 40126 and 85525.

When doing proactive planning Willmann says its important to pay attention to your marginal tax rate. In-State or Out-of-State Meals and Lodging. What can cause your tax return to be audited.

At Universal Tax Professionals we specialize in taxes for travel nurses and other traveling medical professionals. Talk to a tax pro about your industry standards. Fast and Accurate Pay Aya Healthcare.

But it is pretty close. The general rule is. Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax home.

There are two ways you can be paid as a travel nurse. 1 A tax home is your main area not state of work. This is the most common Tax Questions of Travel Nurses we receive all year.

While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage. 0 1500 3000 4500 6000. You file a non-resident state return for the state you worked in and pay tax to that state.

Your home state will give you a credit or partial credit for what you paid the non-resident state. Or are paid a fully taxable hourly wage taxed on the total rate of pay. Prestigious Facilities with Best-in-Class Benefits.

A travel nurse housing stipend is one way to do just that. July 9 2020 529 AM. To accomplish this many recruiters and travel nurses will rely on a ball-park tax rate figure.

Second be ready to track and document your job related expenses. The average hourly rate for a travel nurse is 5649. If the city is not listed but the county is listed use the daily rate of the county.

RN salary in Massachusetts. I could spend a long time on this but here is the 3-sentence definition. FREE YEARLY TAX ORGANIZER.

Stipends are one of the benefits of travel nursing and stipends for some assignments can really sweeten the deal. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage. So what should one expect when making the move from W2 to 1099 for travel nurses.

For instance a travel LD nurse in California will make a. Travel Nurses can receive tax-free money to help them pay for housing transportation and other expenses. Traveling can cause tricky federal and state tax issues and our goal is to make sure you pay as little federal and state taxes as possible.

24 for taxable income between 85526 and 163300.

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

Trusted Event Travel Nurse Taxes 101 Youtube

Top Tax Deductions For Nurses Rn Lpn More Everlance

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

What Is Travel Nursing Academia Labs

Choosing A Healthcare Staffing Agency A Guide For Travel Nurses

Lpn Travel Nurse Salary Comparably

How To Make The Most Money As A Travel Nurse

Travel Nurse Taxes All You Need To Know Origin Travel Nurses