corporate tax increase effects

The negative consequences would include the following. As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th and 99th percentile would.

Monetary And Fiscal Policy Effects On Small Businesses

A corporate tax rate of 28 percent will reduce long-run GDP by about 096 percent or about 1650 per American household.

. For example a rise in corporation tax on business profits has the same effect as an increase in costs. Cullen and Gordon 2002 explore the many potential effects of the tax system on en-trepreneurial activity and find strong empirical support for these tax effects using US. According to the Tax Foundation raising the corporate rate will have an negative.

Under a 25 percent tax rate economic output would be 04 percent lower and the capital stock would be 11 percent smaller. According to an IMF report. Higher corporate taxes reduce patenting R D.

Tariff increases lead in the medium term to economically and statistically significant declines in domestic output and productivity. For example a 10 percent increase in the effective corporate tax rate reduces aggregate investment to GDP ratio by 2 percentage points. By far the largest tax increase accounting for more than half of the net impact of Bidens FY 2023 revenue proposals is an increase in the corporate tax rate from 21 percent to 28 percent.

The Chancellor has confirmed an increase in the corporation tax CT rate from 19 to 25 percent with effect from 1 April 2023. Our economic modeling provides more context for instance about how the effects of a higher corporate income tax rate compound over time which we estimate would reduce GDP by a cumulative 720 billion over. Tariff increases also result in more unemployment higher inequality and real exchange rate appreciation but only small effects on the trade balance.

Means that a low corporate tax rate relative to personal tax rates encourages risk-taking. While the increased amount of corporate taxes paid by corporations does help the average citizen in many ways with increased revenue being paid to the government high corporate income taxes can also directly affect the jobs of people that rely on the corporation to earn a living. The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35 percent to 25 percent would raise GDP by 22 percent increase the private-business capital stock by 62 percent boost wages and hours of work by 19 percent and 03 percent respectively.

The first effect normally raises economic activity through so-called substitution effects while the second effect normally reduces it through so. A fall in corporation tax will increase the post-tax profits of businesses In theory this will increase funds available to fund capital investment eg. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating certain expensing provisions and more.

Our main point is that ETR provides a better measure that captures the entire corporate tax policy effects for a country including the effects arising through statutory tax rates and that ignoring tax credits tax deductions tax exemptions and firms tax planning activities can lead to the coefficient on STR being biased in growth regressions. A rise in interest rates raises the costs to business of borrowing money and also causes consumers to reduce expenditure leading to a fall in business sales. According to a table of projected revenue effects it would reduce projected federal budget deficits by a cumulative 14 trillion in fiscal years 2023 through 2032.

Taxation policy affects business costs. One million jobs lost in the first two years. According to tax experts the more immediate impact of raising the corporate tax will fall squarely on shareholders many of whom are wealthy and in some cases even foreign.

This measure also announces that from 1 April 2023 the Corporation Tax main rate for non-ring fenced profits will be increased to 25 applying to profits over 250000. Meanwhile it will do us good to briefly discuss. Corporate Taxes and Business Relocation.

An increase in the corporate income tax rate to 28 percent would reduce economic output by 08 percent in the long run while reducing the capital stock by 21 percent. Corporate tax rates are also negatively correlated with growth and positively correlated with the size of the informal economy. When the government increases tax on specific commodities consumers will go for substitutes that are relatively affordable.

Raising the corporate rate to 28 percent reduces GDP by 720 billion over ten years according to new economic analysis by the Tax Foundation. This would then cause an outward shift of aggregate demand ADCIGX-M. Bidens Treasury Department estimates that this would raise 13 trillion in corporate taxes over 10 years with some of those revenue increases also coming from a related higher.

If the tax increase affects several services and goods the overall consumer spending reduces significantly. Tax increase leads to demand reduction. This topic effect of corporate tax on the profitability of business organizations reveals both the positive and negative ways in which tax payment has affected the profit structure of business organizations.

Another study from 2017 finds that an increase in state corporate taxes reduces future innovation. The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum tax. Click to see full answer.

In new plant factories and technologies. Individual income tax return data during 1964-93. For instance if the government imposes more taxes on luxury products some people might opt to.

The higher tax rate harms both shareholders and workers. Estimated impact of corporate tax increases on EPS.

Pin On After Effects Animation Projects

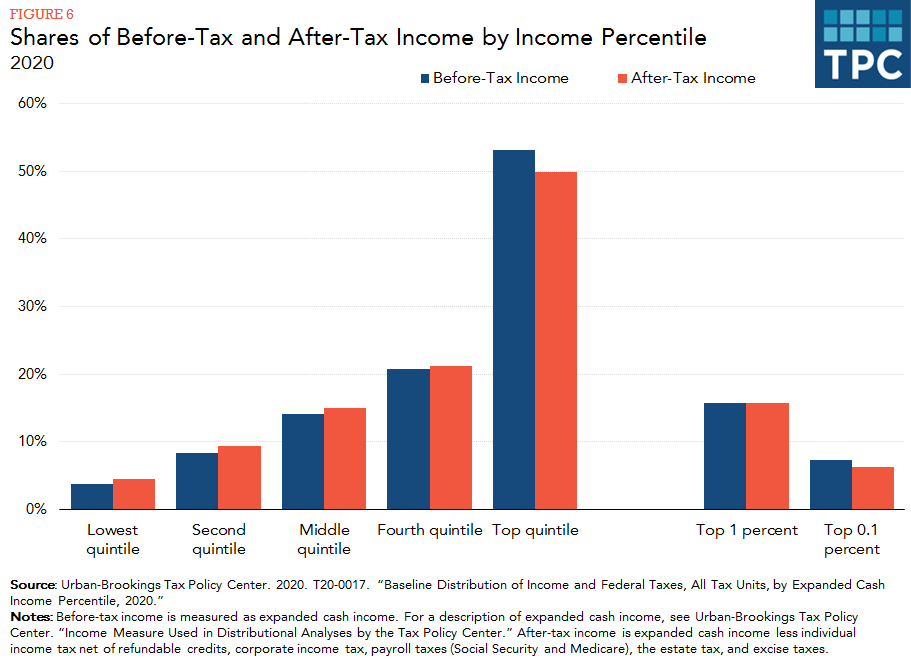

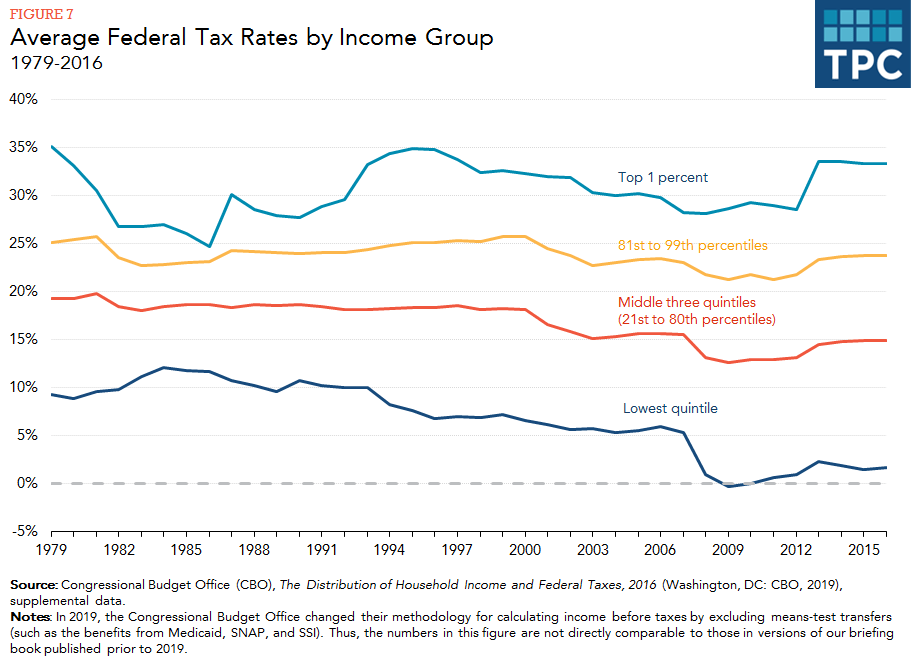

How Do Taxes Affect Income Inequality Tax Policy Center

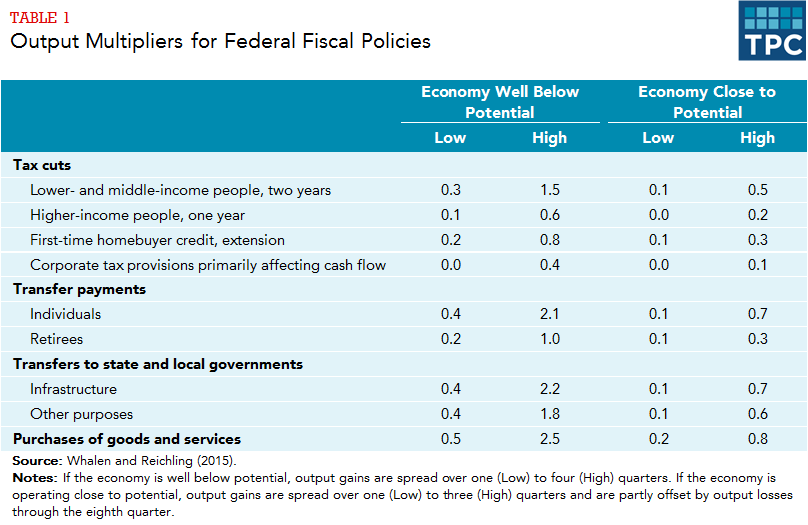

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Tracking Changes In Income Statements With Waterfall Chart Oc Information Visualization Chart Data Visualization

It Is Pretty Well Established That A Tax Increase Especially An Income Tax Increase Will Have An Immediate Negative Effe Part Time Jobs Inequality Income Tax

The Sugar Tax An As Economics Approach Sugar Tax Economics Micro Economics

Biden To Survey Wildfire Damage Make Case For Spending Plan Climate Change Effects How To Plan Corporate Tax Rate

International Corporate Taxation What Reforms What Impact Cairn International Edition

Hud Aim And Callouts Videohive 30952370 Download Resume Videohive Graphing

International Corporate Taxation What Reforms What Impact Cairn International Edition

De Mooij Ruud Aloysius And Li Liu 2018 At A Cost The Real Effects Of Transfer Pricing Regulations Imf Working Pape Transfer Pricing Regulators Transfer

Kowalski Przemyslaw Max Buge Monika Sztajerowska And Matias Egeland 2013 State Owned Enterprises Trade Effects And Pol Enterprise States Baltic States

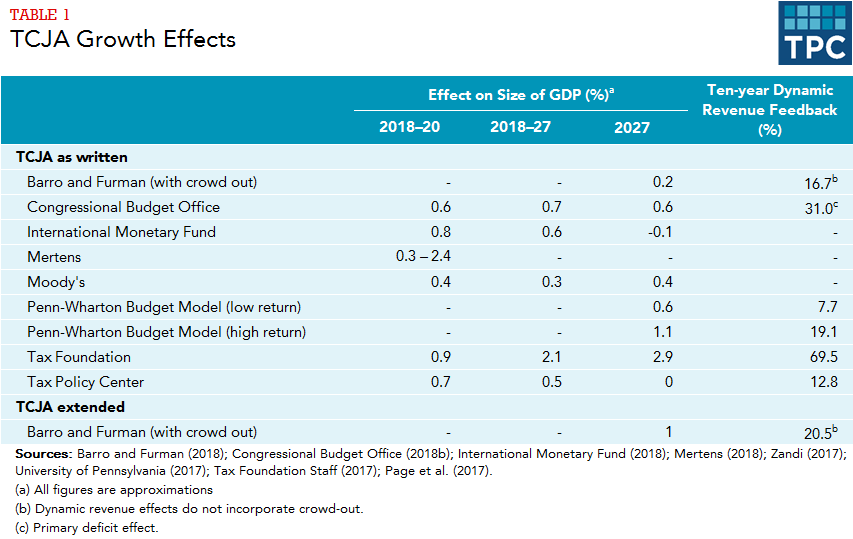

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

Tax Deductions For Teachers Https Www Etax Com Au Teacher Tax Deductions Teacher Tax Deductions Business Tax Tax Advisor

Logos For Increase Economic Tax Revenue Graphic By Setiawanarief111 Creative Fabrica Tax Revenue Icon Design

A Soda Tax Could Prevent 26 000 Deaths Each Year Plexus Products Health And Nutrition Health Tips

How Do Taxes Affect Income Inequality Tax Policy Center

International Corporate Taxation What Reforms What Impact Cairn International Edition